Announcing our Investment in BasiGo

Electrifying mass transit in Africa

I was first introduced to BasiGo by a college friend of mine, who prefaced it by saying “this might not be the typical Silicon Valley VC investment.” This made me even more excited to learn about the opportunity. My friend introduced Katie and I to the CEO and co-founder Jit Bhattacharya, and we were blown away by the passion, knowledge, strength, and commitment of him and the founding team. In addition, they bring decades of operational, market, and financial experience in African cleantech and mobility. Today, we are extremely excited to announce our investment in BasiGo’s seed round.

BasiGo is a “fintech for the climate” company. They provide an electric bus financing product and subscription battery rental and charging service that allows electric mass transit buses to be more profitable than traditional diesel buses that dominate the East African transportation market.

Trends

To put our investment in context:

Climate is the #1 problem facing humanity. To solve this, we have to address the world’s largest emitters (US, China, etc), and also provide solutions so that other regions can benefit from the same standard of living increases that the US and peers have seen. It is imperative that we stop pending climate emissions from developing countries, without impacting their economic development.

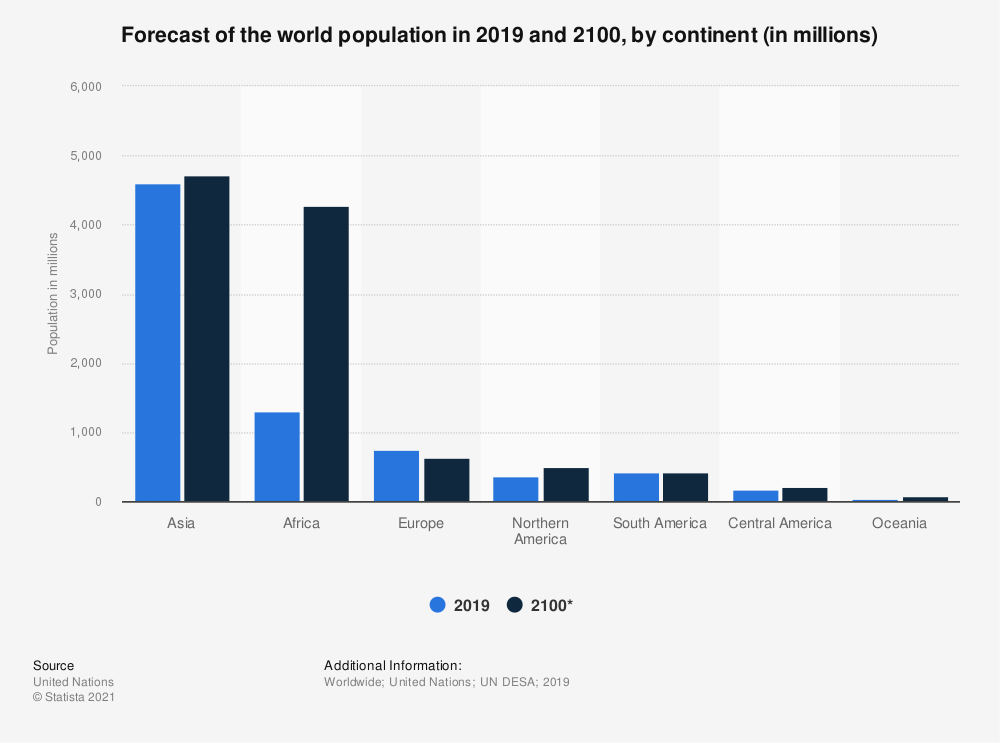

Africa has 1.2B people, growing faster than any other continent (approx. 2.7% a year), and will nearly match Asia as the world’s most populous continent by the end of this century. Africa’s urban population is expected to triple by 2050, to 1.34B people. With an urbanization rate of 58%, Africa will overtake Asia as the world’s most rapidly urbanizing region by 2025.

Population growth and increasing standard of living come with increased emissions. Over time, it’s projected that 95% of emissions will come from outside of the US as the world continues to improve its standard of living (per Jake Levine, Development Finance Corps’ Chief Climate Officer). Without innovations that help reduce the “green premium” down to zero or negative, there will be massive local health consequences of increased emissions (asthma, premature deaths, etc). From 1990 to 2020, per capita emissions on most continents were going down (it takes a certain level of affluence to focus on this), while in Africa it was going up as people get richer (the latter is a great thing!)

Talent is universally distributed across the globe, but opportunity is not. As we look globally, we are excited to find strong entrepreneurs tackling meaningful projects with massive potential across the planet. We’ve seen the dispersion of talent and capital accelerate due to COVID-19, and believe there are many under-appreciated opportunities globally.

While there has not been a lot of massive African startups or exits to date, we believe that will change this decade. Here are a few early examples:

Opay (fintech) closed a $400M round led by Softbank (the firm’s first bet on Africa), valuing the company at $2B.

Chipper Cash (fintech) raised $150M as an extension of their C round valuing the company at $2B (previous investors include Jeff Bezos’ fund Bezos Expeditions, SVB Capital, Tribe Capital).

Swivel, a sustainable mass transit company, was recently valued at $1.5B as part of a pending SPAC deal. Mobility tech in Africa is currently having a moment, see also Max.Ng’s $31M Series B.

Andela, the (originally) African technical talent training platform and recruiting company, was recently valued at $1.5B in a Softbank led round.

As of late, there have been many sources of capital that have made green commitments and are looking for ways to deploy money to meet them. This manifests itself as many financial options available, e.g. concessionary capital, loan guarantees, below market interest rate loans, etc.

Kenya’s power generation is over 90% green. In particular, they have a surplus of green power from local wind at night that can’t yet be matched with sufficient demand. But this is great for charging buses while people sleep!

Product & Business

With those tailwinds and trends in mind, we love what BasiGo is doing.

BasiGo has designed a financial product and battery subscription service that allows the electrification of urban transport buses while saving operators approximately 10-15% on costs compared to a traditional diesel bus. Every expert we talked to told us the electrification of transport in Africa is inevitable, but, historically, there have been four main barriers to e-Bus adoption on the continent: having the right bus for the market, availability of reliable charging options, service and maintenance access, and favorable costs compared to diesel.

The BasiGo solution addresses these problems:

E-Bus Design: BasiGo worked with BYD, the world’s leading e-bus manufacturer, to design a custom first product for the Nairobi market. The first bus is customized in four ways: right hand drive, ground clearance appropriate for Kenyan roads, seating layout meeting local requirements and regulations, and battery and powertrain size to meet the post-pilot use case. From there, we believe these products are generalizable to Kenya and East Africa, as well as to other size buses.

Local Assembly: For a new EV to compete with gas/diesel incumbents in cost-sensitive markets like Africa, EVs must be locally assembled to minimize import duties and taxes. BasiGo is working with one of largest vehicle assemblers in Kenya on a plan to locally assemble their e-buses in Kenya, while growing EV manufacturing capacity and skills.

Charging Infrastructure: BasiGo will build out strategically positioned charging infrastructure to provide convenient, reliable overnight charging for e-Bus operators when power is cheap and there is a surplus of renewables. Also, a BasiGo expert team of electric vehicle service personnel will provide nightly maintenance as e-Buses are charging.

Battery Financing: BasiGo’s unique battery financing facility lets owners purchase an e-Bus for the same upfront cost as a diesel bus, while then financing the e-Bus battery, charging, and maintenance through a mileage-based subscription. The BasiGo subscription is priced to give operators better margins vs. diesel. The founding team is leveraging previous experience in energy asset finance business models from their time at Fenix. Enabling their financing solution is a software driven battery, fleet management and financial management platform. This software backend enables the company to manage the life of each asset while also providing bus operators in Africa with a first-of-its-kind platform for managing bus operations.

Since making our investment late last year, we are very proud to announce Basigo’s first pilot bus has arrived at the port of Mombasa and is currently clearing customs. We believe this is the first modern electric bus in Kenya!

Market size

Nairobi alone has around 12,000 diesel buses operating in the city. There are 75,000 buses across Kenya, and more still across East Africa. Africa, like many emerging markets, is a bus-first market. Modalities common in other parts of the world, such as personal vehicles and ride-sharing, are all secondary to buses and walking. In addition to the urban privately operated system, there exists the opportunity to partner with the government to build an intra-city network. Assuming even a modest market penetration, the resulting revenue compares favorably to some of the higher valued startups we’re seeing in Africa.

Beyond this, as they think about the road towards $1B+ in revenue, their vision is to take the EV Battery financing product and expand it beyond buses, to other high-mileage commercial vehicle applications and ridesharing passenger vehicles. Their goal is to use the pay-as-you-drive battery financing scheme to make the upfront cost of an EV affordable to any urban, high-mileage vehicle application. Expanding in this way will increase the addressable market by a factor of ten compared to buses alone.

Team

The #1 thing we consider when investing at the seed stage is the team. Why are they attracted to this problem and do they have the determination and skills to work tirelessly for many years, and surmount many challenges, in order to realize their vision?

We’re blown away with this team, and their suitability to this specific problem. They have a unique mix of local knowledge and deep East African expertise, as well as international experience as executives of venture backed startups in the US. They have a deep local network in Kenya and are extremely well regarded by potential partners.

Jit, the CEO, is a pioneering clean technology innovator. Prior to launching BasiGo, Jit served as a Principal for Factor[e] Ventures, a global venture fund with a mission to improve lives through increased access to sustainable energy. Based on Nairobi, he was focused on mobility investment. He spent over a decade as a clean-tech executive in Silicon Valley. As the CTO of Fenix International, Jit led product and technology development for a next-generation renewable energy and financial services company that delivered off-grid energy solutions to over 600,000 homes across Africa.

Jonathan Green, the CFO, was Director of Strategy at Fenix International. He helped design the financing model for the B2C solar home system product the company was selling, and served as their de-facto CFO during their acquisition. Jit and Jonathan have extensive experience working together solving hard problems.

Alex Mwaura, the head of customer experience, is an experienced mobility-tech executive in Kenya. He was the Kenya Country Manager for Bolt, a company that overtook Uber to be the largest ride sharing platform in Kenya during Alex’s tenure. Alex has since worked in different parts of bus digitization. He also has extensive startup experience across companies like Taxify (Eastern Europe), Bolt (Ridesharing), and Little.

Sam Kamunya, the head of Business Development, was the founder and director of a Bus Savings and Credit Cooperative (SACCO, the organizations that own and operate buses) where he operated 50 buses. He was responsible for securing bus routes, backstop financing and lobbying with the government on behalf of the members. He even served as a driver himself at one point. Sam was BasiGo’s first customer interview over a year ago when the team was learning about the industry. Sam is from Nairobi.

Why Moxxie?

We aim to be more than just a check for companies. First, capital is a commodity that can be found anywhere. Second, Katie & I are both long-time operators, and believe we can apply our experience over two decades in Silicon Valley to help companies build and scale. Not only will this translate to strong returns for our LPs, but as long time leaders and builders, it gives us immense personal and professional satisfaction.

At Moxxie, we have a variety of backgrounds that can be uniquely useful to BasiGo. Iynna grew up in Africa, and has extensive experience bridging socio-economic gaps via early stage startup investing. Katie used to work for the State Department and can help with US aid organization funding, and necessary US/Kenya governmental relations. I used to run another electric mobility company (Kittyhawk Flyer, an eVTOL product). We’re also excited to help with the “standard” things all startups need, e.g. securing follow-on capital from top-tier VCs, helping to hire, grow, and achieve operational excellence at scale.

On that note, if this mission resonates with you and you’d like to help, they are looking to hire a Chief Operating Officer. If this is you, or anyone you know, please be in touch! (alex at moxxie dot vc).

There is no doubt this will be a long, difficult road, but it’s meaningful, important work, and we couldn’t be more excited about this team and the massive opportunity in front of them.